|

Supporters of the Stronger In Campaign react after heading the result from Orkney in the EU referendum at the Royal Festival Hall, in London, Britain June 24, 2016. [Photo/Agencies] |

Chinese students poised to benefit

Chinese students planning to study in the United Kingdom may gain some short-term benefits as a result of the country voting to leave the EU, according to overseas studies insiders.

Liu Fengjie, director of the UK division of Chivast Education International, a Beijing-based company that helps Chinese students to study overseas, said the students may find it cheaper to study in the UK and easier to work there after the Brexit.

"I also think that some people from EU member countries may leave the UK and their jobs there, which might provide opportunities for Chinese students seeking work," Liu said.

More than 450,000 overseas students went to study in Britain last year, with 130,000 of them from China, according to the British government.

He Chugang, general manager of the South China region at Amber Education, an overseas studies consulting agency, agreed with Liu that the cost of studying in the UK will be lower.

He was surprised by the high turnout for the referendum, adding that many features of the UK-its economy, culture and others-are closely connected with the EU.

"Leaving the EU is of no benefit for the country," He said. "Further effects on international education remain to be seen."

|

Tower Bridge in London, the United Kingdom, Nov 17, 2014. [Photo/IC] |

Vote could stimulate tourism

The Brexit may attract more Chinese tourists due to the decline of the British pound, experts said.

"The most important impact on Chinese tourists is the possible currency fluctuations," said Jiang Yiyi, director of the International Tourism Development Institute.

If the British currency keeps tumbling against the renminbi, the yuan's purchasing power will increase. "Traveling to the United Kingdom may become cheaper, and Chinese tourists will be more willing to go there," she said.

About 270,000 Chinese tourists visited Britain last year, a 46 percent increase over the previous year, according to the British government.

Jiang said that the visa policy toward Chinese may not see big changes after the Brexit, because the UK did not adopt the Schengen visa.

But Britain has bilateral visa agreements with European countries. For example, it has a deal with Belgium to allow visa holders of either country to enter the other.

"But after the Brexit, we don't know if the situation will change," she said.

Xu Xiaolei, chief branding officer at Aoyou.com, an online booking website, also said the falling pound might make UK travel cheaper and it could also present an opportunity for Chinese capital to purchase British tourism assets.

|

Chinese homebuyers at a real estate exhibition for overseas projects. [Photo provided to China Daily] |

No homebuying sprees expected

The Brexit will have a limited impact on Chinese homebuyers in the United Kingdom because most of those purchases are not made as investments, but for other reasons, said Charles Pittar, chief executive officer of international property listings portal Juwai.com.

Education is the chief reason Chinese buy houses in the UK, Pittar said.

"For most Chinese buyers, it is a long-term game. If they want to buy an apartment for their children in preparation for college, they shouldn't be too worried about the Brexit," said Pittar.

In a Juwai survey conducted in early June, 51 percent of the 411 Chinese real estate professionals and investors who were polled had temporarily postponed their property transactions in the UK pending the outcome of the vote.

Justina Fan, executive director at global property service provider DTZ/Cushman & Wakefield, said that the Brexit will have little effect on the UK housing market.

"For one thing, the UK's housing market is always in short supply. Stable population increase, as well as changes of people's mindset, resulting in an increasing rate of people living alone, have helped to boost the demand for housing. But in terms of supply, development of new housing projects is limited by conservative urban development ideas and extremely high land prices," she said.

|

Wang Jianlin, chairman of Dalian Wanda Group, talks to UK Prime Minister David Cameron on Jan 24, 2014 in Davos, Switzerland.[Photo/Provided to chinadaily.com.cn] |

Companies may face challenges

Chinese enterprises may face challenges in using Britain's position as a gateway to expand their businesses in other European countries after the United Kingdom voted to leave the European Union, according to an insider.

Andrew Yuan, managing director of Hytera Communications UK, said Chinese companies in Britain are likely to see their businesses hurt by the decision, as many of them use UK headquarters to cover their business in other EU countries.

"Take my company as an example. About 45 percent of our revenue last year came from European countries outside the UK. I am worried that about one-third of our businesses may be dampened if the UK actually leaves the EU."

Hytera, a company based in Shenzhen, Guangdong province, specializes in designing and manufacturing mobile radio communications equipments.

It set up a representative office in the UK in 2005, which has evolved into a headquarters covering markets in western and northern Europe.

Zeng Gang, a senior researcher at the Chinese Academy of Social Sciences' Institute of Finance and Banking, said the Brexit would hit the British pound, causing a negative impact on pound-related assets in Britain.

"Chinese companies owning assets in Britain should readjust their strategies and look to diversify their investment in other European countries if they plan to expand their influence in Europe," he said.

|

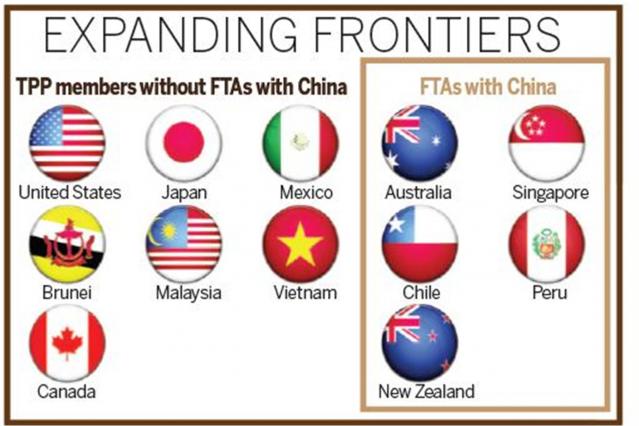

UK likely to pursue China FTA

Sooner or later, the United Kingdom, if it wants to remain competitive, will follow in Switzerland and Norway's footsteps to enter into free trade agreement talks with China after withdrawing from the European Union, experts said.

Wealthy non-EU member Switzerland signed a free trade agreement with China in 2014, and Norway is now in talks with China to reach a bilateral free trade deal.

Ma Yu, a senior researcher at the Chinese Academy of International Trade and Economic Cooperation in Beijing, said the UK was Chinese companies' favorite European investment destination and has strong business and diplomatic ties with China.

"Under such circumstances, it shouldn't take long to complete China-UK free trade agreement talks if both sides want it to be done within a short period," said Ma.

"However, because the UK used to have a strong voice in Brussels, its withdrawal from the EU will raise China's time and resource costs in negotiating the China-EU free trade agreement and a comprehensive EU-China investment agreement with the EU without the UK," said He Wenwei, director of the research center for European and American studies at the China Association of International Trade in Beijing.

Trade of goods between China and the European Union amounted to $564.85 billion in 2015, while trade between China and the UK reached $78.54 billion, according to the General Administration of Customs.

|

A 0 banknote is placed next to 100 yuan banknotes in this October 16, 2010 file illustration picture taken in Beijing. [Photo/Agencies] |

Offshore RMB centers boosted

The status of Frankfurt, Luxembourg and Paris as offshore renminbi centers will improve significantly after the United Kingdom voted to leave the European Union, experts said.

Wen Bin, chief researcher at China Minsheng Banking Corp, said the status of London as a global financial center will be weakened after Britain withdraws from the EU.

"It will trigger an increase in the size and volume of cross-border renminbi transactions at the other three offshore renminbi centers in Europe, which will replace London, while China is pushing forward such transactions under the framework of the Belt and Road Initiative," Wen said.

He expects the renminbi to fall slightly against the US dollar but to remain relatively stable against a basket of currencies.

Zong Liang, deputy director of the Institute of International Finance at the Bank of China, said the British exit will also lead to Chinese banks that are expanding their business worldwide to readjust their global strategies by accelerating deployment in countries such as Germany and France.

Wen agreed, saying that huge business opportunities will emerge for Chinese banks in Europe, whereas their business in London may slow.

Sun Yu, president of Bank of China's London branch, said: "The Brexit will bring uncertainties to ... large international banks. Its impact on London as a world financial center will affect the future strategy of banks. Previously, all European banks used London as their business hub."

© China Daily Information Co